Shipston Group Limited is an international investment firm founded in 1996 by the renowned investor, businessman and industrialist Michael D. Dingman.

Our strategy is to identify companies with strong market positions and growth potential. Then, we use our considerable investment capital, operating expertise, and extensive business network to assist portfolio companies in designing and implementing plans that improve operations and efficiency. Shipston’s core investment philosophy rests on the belief that trusting relationships drive revenue, which allows the company to unlock opportunities and create value.

Our History & Core Structure

Unlike traditional private equity firms, the Shipston Group does not have limited partners and is not constrained by investment holding periods or defined by IRR. We take positions in great people and develop management according to an aligned vision of long-term value creation. While we invest and operate in regions around the globe, our values and culture remain consistent and are critical to our success.

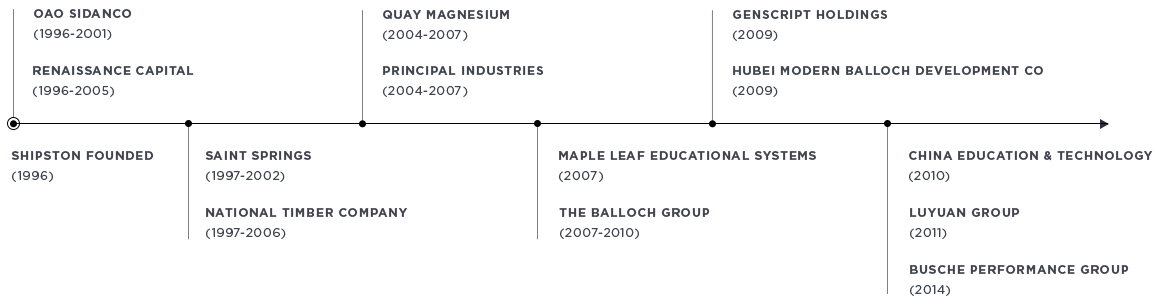

Since 1996, Shipston has held a diversity of investments in the United States, Eastern Europe, Russia, Australia and China. We have extensive experience generating and leading investments through acquisitions, initial public offerings and complex corporate transactions that involve transforming operating units into new public ownership structures. We first began investing in emerging markets during Russia’s period of privatization, when we sought out restructuring opportunities. We became an early investor in the country’s largest investment bank and one of its top oil companies.

In 2005, Shipston started investing heavily in China and quickly developed a deep fluency and expertise in navigating the Chinese market. Today, our offices in Beijing and Nanjing identify new opportunities to invest in companies, drive internal growth and improve efficiencies. We have backed companies in a variety of industries in China, including biotech, clean energy, transportation, healthcare, manufacturing, natural resources and real estate.

In 2014, Shipston began devoting more resources to investment opportunities in the United States. We leverage our team’s strong experience in industrial-based investing to fuel sustainable growth and drive long-term value creation. Shipston made Busche Performance Group, one of North America’s largest vertically-integrated casting and machining suppliers of high quality chassis components, its first and primary investment in the United States. Shipston’s long-term investment goals are to strengthen Busche’s position as an industry leader and provide the necessary support to expand its supplier base.

A Timeline of Investments